-

Falling interest rates could help impact allocations, says BlueOrchard

24 December 2024 -

New Agriculture prepares to launch degraded landscape fund

23 December 2024 -

France to update green bond framework for first time in 2025

20 December 2024 -

'Ground-breaking' UK carbon capture and storage project secures £8bn financing

20 December 2024 -

NTR to invest in long-term storage solutions in 2025

20 December 2024 -

Positive prospects for sustainable investment despite US policy headwinds, Impax says

20 December 2024 -

People moves, 20 December: AIGCC, Canopius Group, Label ISR ... and more

20 December 2024 -

Investors must 'start asking smart questions' on nature, says SBTN

19 December 2024 -

Germany to raise €15bn from green bonds in 2025

19 December 2024 -

Canada publishes 'ISSB-aligned' standards, affords flexibility on timing of disclosures

19 December 2024 -

EU 'transition' benchmarks pitched to incentivise taxonomy-aligned capex spending

19 December 2024 -

2025 growth expected for 'hard to miss' sustainable sukuk market

19 December 2024 -

German ministers propose vast cutbacks to CSRD

18 December 2024 -

China and India join 31-member network for ISSB adoption in emerging markets

18 December 2024 -

Family offices interest for impact set to boom, says GIIN

18 December 2024 -

Sustainable debt round-up: India, Centara, ESR ... and more

18 December 2024 -

UK's FCA consults on sustainability disclosure for private company trading platform

18 December 2024 -

EIOPA and ECB endorse pan-EU reinsurance pool to address natcat protection gap

18 December 2024

- The top 10 most-read stories of 2024 - and the themes they reveal

- Will impact investing finally take centre-stage in 2025?

- SLM Partners explains its award-winning impact reporting approach

- Falling interest rates could help impact allocations, says BlueOrchard

- New Agriculture prepares to launch degraded landscape fund

- 'Ground-breaking' UK carbon capture and storage project secures £8bn financing

- 360 Capital climate tech fund raises €140m at first close

- Scrambled regs to give investors indigestion in 2025

- Social issues should not play 'second fiddle' to environment, says Triodos chair

- France to update green bond framework for first time in 2025

-

23 December 2024

360 Capital climate tech fund raises €140m at first close

-

23 December 2024

Marguerite raises €700m for third infra fund

-

23 December 2024

Côte d'Ivoire solar plant secures over €50m from backers

-

20 December 2024

Social issues should not play 'second fiddle' to environment, says Triodos chair

-

20 December 2024

SFDR categories can address vagaries of Article 8 and 9, says research

-

19 December 2024

Regulator waters down Indian sustainability reporting requirements

-

19 December 2024

US says private capital key to achieving updated NDC

-

19 December 2024

JET Charge raises AUD72m for EV charging infrastructure

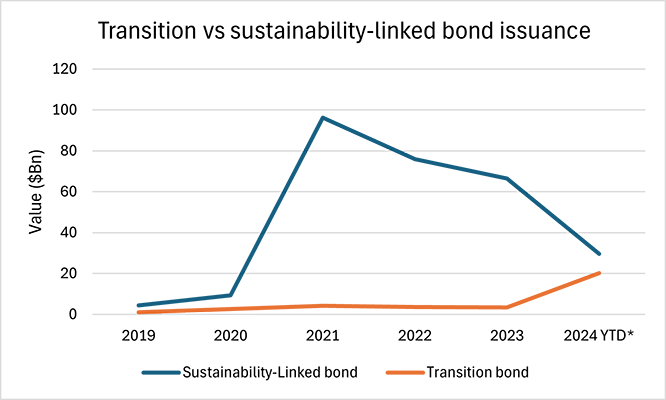

Transition vs sustainability-linked bond issuance

With 2024 coming to a close one of the big stories this year has been the collapse of the sustainability-linked bond label while simultaneously there has been a rise in the transition label thanks to Japan's pioneering sovereign transition bonds. Looking at the trajectory of both labels we can see how after a peak in sustainability- linked bond issuance in 2021 the label has been trending downward with an accelerated drop-off in 2024. Conversely Transition bonds have stayed flat relatively throughout this period, only really picking up in 2024, to the point that both labels have nearly reached a crossover point this year.

For comprehensive data on all green, social, sustainability and sustainability-linked bonds and loans, please visit EF Data. For more information, a demo or a free trial please contact scott.davis@fieldgibsonmedia.com